Greetings and salutations to all! After the third day of subscription, we are now delving into the specific state of the Kataria Industries IPO. We’ll look at the statistics on subscriptions, possible listing gains, and investment strategy ideas. This page contains important information for anyone who have applied for this IPO already or are thinking about doing so.

Table of Contents

Synopsis of Kataria Industries’ IPO History

In the manufacturing industry, Kataria Industries is becoming more and more well-known for its cutting-edge goods and solid business strategy. The business has made the decision to go public in order to raise money for growth and new initiatives, providing investors with a sizable opportunity.

Specifics of the IPO

Each share has a face value of ₹10, and ₹96 is the cut-off price. The IPO is one of the most significant recent public offerings, with a target of raising about ₹554 crores. The NSE will list the shares, providing plenty of trading options and liquidity.

Details of Subscription

Status of Subscription Following Day Three

The reaction to the Kataria Industries IPO has been tremendous; by the conclusion of the third day, the total subscription had surpassed the issue size by 394 times. This degree of subscription shows that investors are confident in the company and that there is a significant demand.

Quantity of Received Bids

Bids totaling ₹14,000 crores were made during the IPO, indicating significant interest from a range of investor types. This intense bidding signals that there will be fierce competition for the allotment.

Examination of Qualified Institutional Buyers (QIB) Subscription Categories

The IPO in the QIB category received about 171 subscriptions. Large institutional investors including insurance firms, mutual funds, and foreign institutional investors fall under this group.

Investors who are not institutional (NII)

About 970 subscriptions were made to the NII category, which comprises high-net-worth individuals and corporate entities. This suggests that wealthy investors hoping to profit from the IPO are very interested.

Individual Investors

About 274 individual investors, including yourself and me, were retail investors who subscribed to the IPO. This significant involvement demonstrates how well-liked Kataria Industries is by the broader population.

Allocation and Distribution: Distribution Procedure

Because of the significant number of subscriptions, the shares will be distributed through a lottery. This guarantees an equitable allocation of shares among the candidates.

Allotment Dates

The critical dates to note are:

- Allotment finalization: July 22

- Refund initiation: July 23

- Shares credited to Demat accounts: July 23

- Listing date: July 24

Anticipated Listing Profits

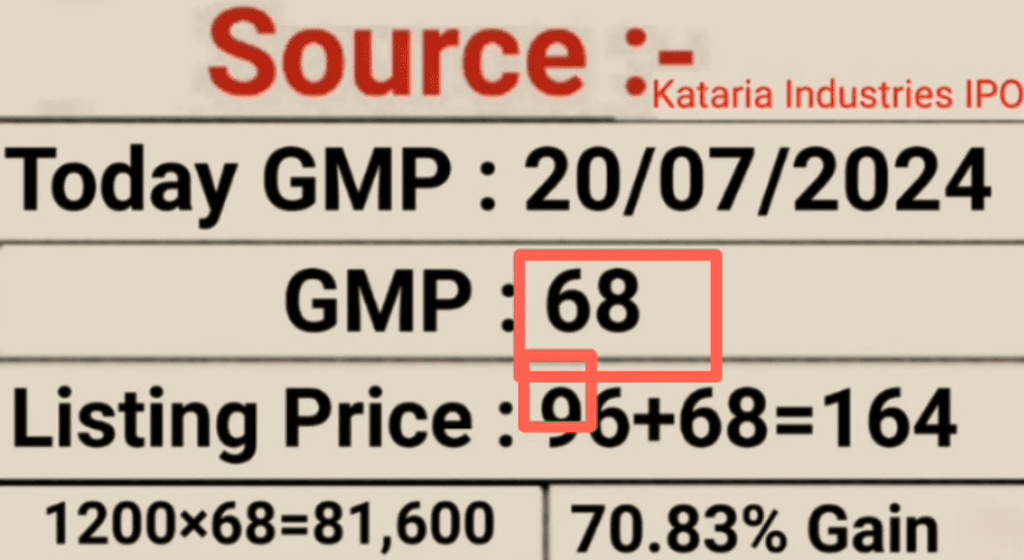

Analysis of Grey Market Premium (GMP)

Strong predicted listing gains are indicated by Kataria Industries’ IPO’s high Grey Market Premium (GMP). The GMP has been ₹8, indicating a listing price of about ₹104, which would yield a respectable return for investors.

Impact of Market Conditions

The current state of the market will also affect the real listing gains. Higher listing gains are what investors can anticipate if the market stays steady or positive.

Investors’ Strategic Perspectives on Investment Strategy Following Allotment

It is imperative that you organize your strategy if you are given an allotment. It may be more profitable to keep the shares for a few days after listing, given the strong GMP and subscription levels.

Prolonged versus Immediate Holding

With Kataria Industries’ solid foundations, a long-term holding approach might also be advantageous. Prior to making a choice, consider your risk tolerance and financial objectives.

The Financial Health of the Company: Fundamentals and Assessment

With a Price to Book Value of 4.24 and a Return on Equity (ROE) of 24.5%, Kataria Industries has demonstrated strong financial performance. These figures point to a robust and maybe successful business.

Ratio of Debt to Equity

The company’s sustainable debt to equity ratio of 1.3 should be kept an eye on in case it changes significantly.

The part played by anchor investors

An IPO’s credibility is greatly enhanced by anchor investors. Usually, they are sizable institutional investors who make a commitment to purchase shares prior to the first public offering.

Anchor Investors’ Effect on IPO

The involvement of anchor investors frequently draws in additional institutional and individual investors, which boosts the IPO’s overall success.

Important Dates and Schedule

The following dates are significant to the Kataria Industries IPO:

- IPO Open Date: July 15

- IPO Close Date: July 19

- Allotment Date: July 22

- Refund Initiation: July 23

- Shares Credited to Demat Accounts: July 23

- Listing Date: July 24

How to Apply for IPO

Steps for Applying

To apply for the Kataria Industries IPO, follow these steps:

- Log in to your trading account.

- Navigate to the IPO section.

- Select Kataria Industries IPO.

- Enter the number of shares you wish to apply for.

- Complete the payment process.

Several Demat Accounts

Applying to IPOs through a number of Demat accounts can improve your chances of getting allotted. To get the most of your applications, you can create extra accounts for relatives.

In summary

There has been a lot of interest in the Kataria Industries IPO, and listing gains could be favorable. Understanding the subscription details, allotment procedure, and strategic insights will help you make well-informed investing selections, regardless of your level of wealth. Take advantage of this investment opportunity by staying up to date with the most recent market developments.

What is the total issue size of the Kataria Industries IPO?

The total issue size is approximately ₹554 crores.

When will the shares be credited to my Demat account?

The shares will be credited on July 23.

Can I sell my shares immediately after listing?

Yes, you can sell your shares immediately after they are listed on the stock exchange.

What is the role of anchor investors in an IPO?

Anchor investors help boost the credibility of the IPO and attract more investors.

Is it beneficial to hold Kataria Industries shares for the long term?

Based on the company’s strong fundamentals, holding the shares for the long term could be beneficial.

What is the face value of Kataria Industries IPO?

The face value is ₹10 per share.

What is the cut-off price for the IPO?

The cut-off price is ₹96 per share.

When will the allotment be finalized?

The allotment will be finalized on July 22.

What are the expected listing gains?

Based on the Grey Market Premium, expected listing gains could be around ₹8 per share.

How can I increase my chances of getting an allotment?

Applying through multiple Demat accounts can increase your chances.

Latests Posts

“Trump Reveals Shocking Iranian Assassination Plot After Alarming U.S. Intelligence Briefing!”

Spread the loveFormer U.S. President Donald J. Trump, now a contender in the 2024 presidential race,…

“Behind the Scenes: How Silicon Valley’s Richest Woman is Secretly Powering Kamala Harris’s Political Rise”

Spread the loveThe friendship between Kamala Harris and Laurene Powell Jobs has not only become a po…

Tirupati Temple Purification Ceremony Amid Controversy Over Animal Fat in Ghee for Laddoos

Spread the loveThe Tirupati Temple, a sacred site for millions of Hindus, has found itself embroiled…

Pics: The 297 Antiquities US Handed Over To India During PM Modi’s Visit

Spread the loveIntroduction In a historic move, the United States handed over 297 ancient Indian ant…

Kalki 2898 AD Movie Review: 'Kalki' can give new heights to Prabhas' career

Spread the loveI was looking for a good movie for a long time. Here a good movie means a story that …

Apple has given this special feature in Airpods for the first time, the battery is very powerful, this is the price in India

Spread the loveApple has introduced the iPhone 16 series as well as AirPods 4 at its GlowTime event.…